Technical Note #24 About Carbon Tax Legislation

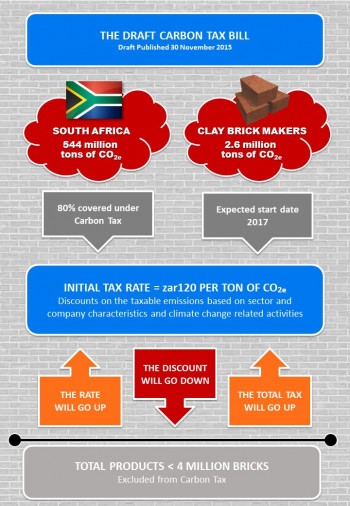

This summary is based on the Draft South African Carbon Tax Regulations published by National Treasury on 30 November 2015.

Following a number of policy documents and stakeholder consultations, National Treasury (NT) published a Draft Carbon Tax Bill in November 2015 (the ‘Carbon Tax’). The bill calls for a levy of 120 ZAR/tCO2e (rand per tonne of carbon dioxide equivalent) emitted, which may be adjusted by the Minister of Finance as part of the annual budgetary process. Although the details are still being discussed, a basic tax-free threshold would be set at 60% - 70% for all sectors, with a maximum obtainable tax-free threshold of 75% - 95% when taking into account various adjustment to the basic threshold.

The Carbon Tax focusses on the country’s carbon intensive industries including the clay brick sector. The current design of the Carbon Tax indicates the eligibility specific tax-free thresholds per sector.

It is estimated that the formal brick making sector in South African emits roughly 2.6 million tCO2e/year. The Carbon Tax intends to not only cover the emission of GHGs resulting from the combustion of fossil fuels, but also emissions resulting from chemical processes (so-called process emissions) and emissions from organic sources (so-called fugitive emissions).

Brickmakers that produce more than 4 million bricks per year will be required to pay Carbon Tax. By using the Carbon Tax impact assessment model as provided in the download, brickmakers can determine the total amount of Carbon Tax that they will have to pay per year.

Lead department: National Treasury